Wouldn’t you like to save more money or be more accountable for your savings? Waste of money makes all these impossible. If you are working or involved in businesses, you will make money that sums millions of dollars, but you wouldn’t know that.

The sad part is that most of the things you waste money on will only give you short-lived joy and little value to your life. You can imagine seeing a new nail design on your friends’ hands, rushing to get it done, and later regretting it. You could always paint your nails yourself, and we have many DIY nail tutorials to take care of that.

This is one example of what people waste money on; below, we explore ten waste of money and how not to waste it. As the saying goes, “The best things in life are free,” and you must tap into them to enjoy life better.

1. Home Entertainment Subscription

Have you ever wondered why the entertainment industry is one of the biggest in the world? People get bored quickly and can’t decide what they want. That is why one can have the standard cable subscription, HBO, Hulu, Apple Tv, Netflix, and even Hulu running together.

The way each platform is structured makes you feel like you can’t get the same things anywhere else. That might be the truth, but if you fall for these ploys, you spend too much time on TV and waste money. Staying updated on TV shows is cool, but you must compromise if you wish to save money.

You might even find the same shows on two platforms when you research these platforms. Platforms like Amazon Prime carry Tv shows and movies from diverse providers to give you complete entertainment. If you are not easily satisfied, you can add another one that offers live Tv.

The bottom line is whatever you do, avoid getting more than two running entertainment subscriptions running together.

2. Bank Fees

If you have a bank account, you can’t avoid all the fees from ATM, bank, and processing fees. When you leave it unchecked, the prices slowly bleed your account dry, but you might not notice because you are constantly adding and removing money. You must often withdraw money, which requires you to pay fees.

We are not saying you shouldn’t use bank accounts anymore, that would complicate your life even more, but you must be smart about it. You can try different things to reduce the fees, either changing your account type with minimal costs or changing how you make deposits.

Also, if your current banking institution is not giving the best rates, you should switch to a cheaper option. You might find out that you can even get a higher interest rate on your savings. This is a plus for you in the bid to stop wasting money.

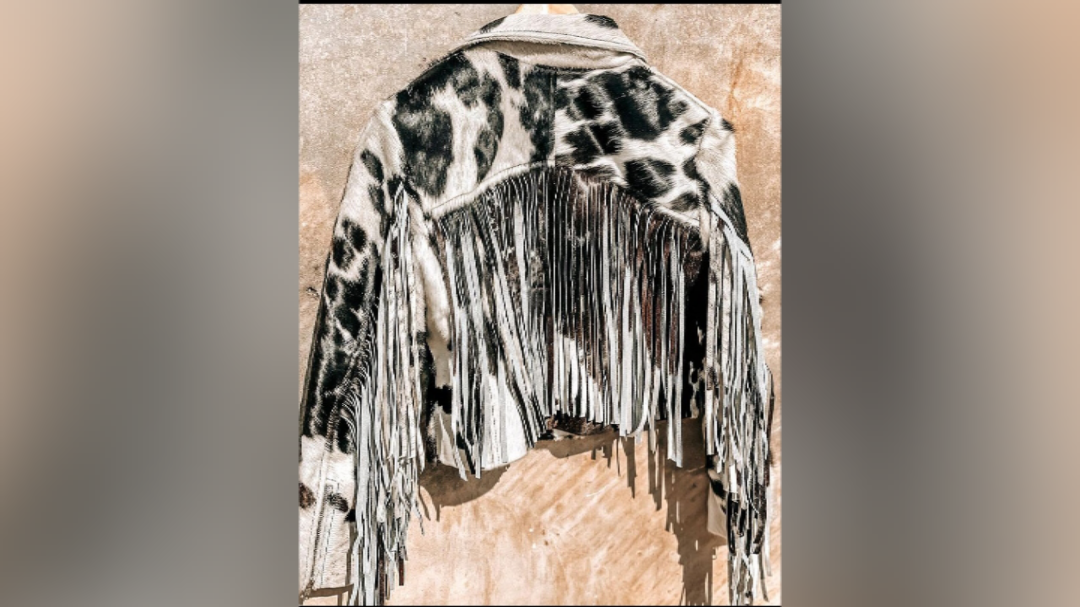

3. Spending Too Much Money on Beauty and Fashion

Most people spend their money and precious time trying to look like a million bucks for pictures, status, and social media. If you are one of those people who like to do weekly hair, nails, and body grooming even if you don’t need that is a waste of money.

No one is saying you should look unkept, but there are many things you can do yourself to look presentable without going to the salon. Facials, spa dates, and all the allure of beauty are all vanity, come to think of it, because they are always temporary.

The best thing is taking care of your skin; natural ingredients and formulas are proven to be the best option. If you like makeup products, read reviews and find multipurpose ones instead of buying every new item from your favorite brands.

They will help you save money since you can use one product for different things. Shopping for the trendiest clothes or having a high taste for the only luxury item is a waste of money. Some people even try to look like celebs, ending up bankrupt with their lifestyle choices.

We believe in shopping for staple clothing items and adding a few stylish pieces so you can combine them to create several outfits. If you need a little inspiration, we have different posts on how to style one item in versatile ways.

If you’re lucky enough that these things don’t move well, not wearing the trendy outfits won’t take anything from you.

4. Cost of Credit Cards

Credit cards make life more convenient; you can spend your money whenever possible and solve emergency problems. Most banks even throw in sweet deals to help you earn air miles and cash back as you spend with your credit card.

All the fees and penalties attached to the cards, especially when you default, are just another way for them to eat into your money. If you are going to get a credit card with the lowest interest rate, there is always a better chance of getting a lower offer; you must keep checks.

When you get the card, keep tabs on the card and offset the monthly balance so you don’t get charged the interest rates. This will also help you avoid those unnecessary bills, which are a waste of money.

5. Frequent Outings

If your first thought is to eat out every time, you should stop it and restrict outings to whenever something important happens. You might see ordering food as time-saving and an easy way out, but it is only a waste of money when it is unnecessary. It is better to plan your meals weekly, food is essential, and you shouldn’t skip meals because of poor spending habits.

You can also turn down casual outing requests that are too frequent, only squeeze in a few. We are not saying you should live like a monk or have zero social life, but tone it down if you must succeed in reducing eating out. You will realize that you have saved yourself from unwanted expenses.

6. Unused Membership/Subscriptions

Several membership opportunities promise exclusive offers when you subscribe. Some of them wouldn’t even allow you entry without paying the fee, after which you will find out you don’t use the features as much. Such reoccurring payments reduce your monthly income before you even budget your funds.

The most common is gym membership fees, which often go unused. Unless you are an exercise enthusiast or need the adrenaline of gyms to stay motivated, you are better off not paying the membership fees. Sometimes you are dangled with a discount to pay for a yearly subscription, and you fall for it.

The companies are sure you won’t get the value for your money because it is impossible to need their services continuously. In exchange for a gym membership, getting a bike, or taking walks, if you require high-intensity exercises, there are many free videos online to help you.

With other services and apps that require a subscription before, you may ask yourself if you absolutely cannot survive without using them. You should also evaluate the worth you are getting for the money you are about to spend; if it is not at a significant loss, then you can subscribe.

7. Bad Habits

When you spend money managing your bad habits, you are not only practicing waste of money but also harming your health. A perfect example of an expensive bad habit is smoking; the cost of cigarettes might seem small until you calculate how much it costs annually.

You could put that money to better use if you could try to work on yourself. If you are a smoker, you would disagree with the above statement because you see people who do not smoke but still have poor spending habits. Instead of arguing with the theory, experiment with it and see if it affects your life positively.

You would be saving yourself from medical bills and possible debts smoking can put you into. Another bad habit people waste money on is drinking; most adults indulge in both or one. You might feel that your body needs it to feel alright, but the truth is, it’s your mind playing tricks on you.

Overeating or making special food request will only cause a dip in your pocket and make you unhealthy in the long run. It is always best to do things on average and maintain good habits.

8. Spending to Save

One of the best ways a brand gets your attention is by offering discounts and sales. They are all marketing strategies to ensure you make that purchase today. We are guilty of such spending when the deals are just so watering, especially if it’s something you’ve been wanting.

It is usually a rush sale, so you don’t have much time to think about it. However, you might save money by slowing down and allowing your brain to cool off even with the slashed prices. Come to think of it, if there is buy one get one free on a shoe, do you need a second shoe of the same design?

Sometimes all it takes is free shipping to get your credit card out. You should that stop because the money you are about to spend buying the item compared to the shipping price is a small amount. If you need the item and have the money for it, you should buy it. Otherwise, do yourself a favor and ignore instead of piling up debts.

9. Gambling and Quick Money-making Schemes

There is an easy way to make money, and you certainly, shouldn’t gamble the one you have away, but do you listen? Nowadays, it has become easier to play the lottery or play all sorts of gambles online. In a twinkle of an eye, your money goes down the drain, or you can be so lucky and win back some few bucks.

The odds of winning are always slim because they, too, don’t want to lose, but they make you feel like you are close, so you are willing to pay again. It would help if you didn’t involve yourself in such games with a high risk of losing money; instead, try to make intelligent investments.

Various honest assets are worth your hard-earned money, but the returns are slow and small, just as is the law of life. Nothing good comes easy, so don’t gamble away the fortune you should be saving.

10. Emotional and Impulse Buying

Allowing your emotions to control spending is an easy way to waste your money. It takes you out of your budget, that’s if you have one, to begin with. Resist the temptation of impulse buying just because your mind says you need it. One way to reduce your shopping is to avoid the sites with friendly offers.

If you can’t resist the urge to add to the cart, add the items but don’t pay immediately, even if the sale ends. You should wait for two days, and if you don’t rush to pay for the items, you never really needed them as opposed to what your emotions told you.

Some people have become so attached to brand names that they would still buy them even if it is the most expensive product. If you carry out a little research, you might find more effective products at a cheaper rate.

You might also need to have your home looking or smelling a certain way, only to waste money on cleaning supplies you don’t need. It is just your emotion playing with you or you trying to compare yourself with others when it is not worth it.

Tips for Saving Money

To save money, you don’t have to be frugal or derive yourself from enjoying the pleasures of life. Follow these tips to stay on top of your savings.

- Never spend more than you earn; your saving should be at least 50% of your earnings.

- Saving your money automatic is always the best option. So, if you commit to a saving plan, ensure you make it intuitive and consistent.

- Spend your money only on things that add value to your life. Value is relative to different people, but you can always compare offers to get the best.

What to read next:

–10 Best Water Ionizers, Reviews, Price, Benefits, And Features For Your Home

–How To Pop Lower Back: Easing Tension In Your Spine Like A Chiropractor

–Black Shirt Outfit For Women And Men- 15 Ways To Wear A Black Shirt Correctly

About Me

Fashion & Beauty Enthusiast

Hi, I'm Fanti. I'm a fashion, beauty, and lifestyle enthusiast, and the ultimate curves queen. Here, I share beauty, fashion, and lifestyle tips to teach, inspire, and give confidence to all women.